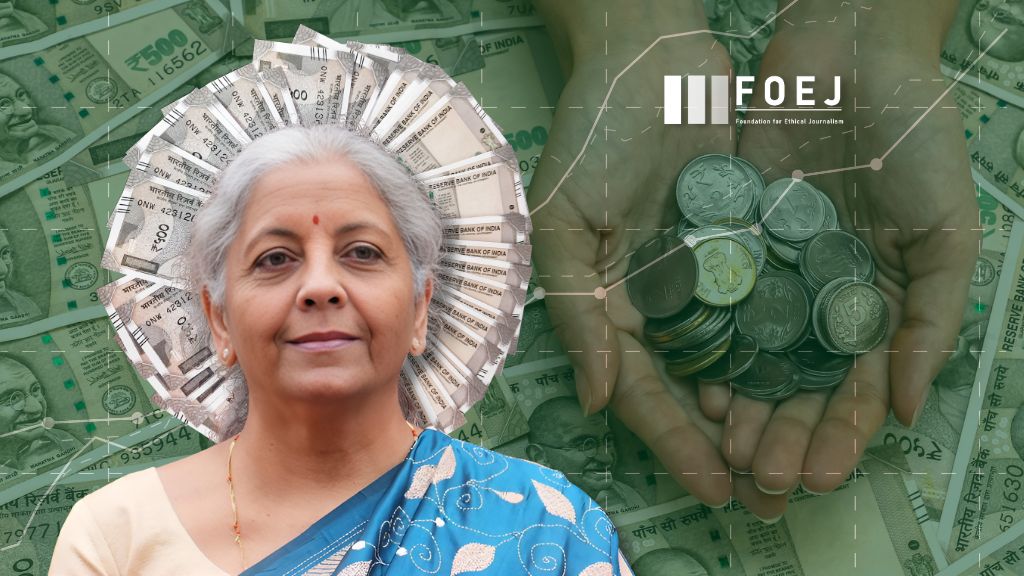

Finance Minister Nirmala Sitharaman presented the Economic Survey 2023-24 in Parliament on Monday, a day before she will present her seventh Union Budget. She said the Indian economy is in a strong and stable position and is handling global challenges well. “strong wicket and stable footing,” Sitharaman highlighted.

During her intervention in Lok Sabha she says, “I agree with the Hon’ble MP that staffing and filling up vacancies at NCLT & NCLAT is a challenge which we are trying to address. We are conducting periodic interviews, advertising for positions, and working with the Supreme Court so that we get the right members to appoint them in various company law tribunals. It is true that there is one NCLAT located in Tamil Nadu. I am sure that for now, at least the southern states would find that it is not located in the north but is located in Chennai, and it would serve the purpose. I do appreciate that we need to have a greater number of appellate tribunals. Both NCLT and NCLAT appointments are being taken seriously by all of us. We are trying to fill them up speedily. Let me assure the Members that filling up of these positions is happening with a greater sense of urgency”

What Does the Report Say?

“The Indian economy is on a strong wicket and stable footing (and) demonstrating resilience in the face of geopolitical challenges. The economy has consolidated post-Covid recovery with policymakers – fiscal and monetary – ensuring economic and financial stability…” the report said.

Ms. Sitharaman highlighted that the economy is expected to grow by 8.2% in FY24, with growth exceeding 8% in three out of four quarters. She expects the positive momentum from FY23 and FY24 to continue into FY25, which is projected to have a growth rate between 6.5% and 7%.

“Prospects for continued strong growth beyond FY25 look good… subject to geopolitical, financial market and climatic risks”, the Finance Minister said in the Lok Sabha.

“The stark difference in growth performance of countries has been on account of domestic structural issues (and) uneven exposure to geopolitical conflicts…” the report said.

Headline inflation is expected to be 4.5% in FY25 and 4.1% the following year, according to the Reserve Bank. This assumes normal weather conditions and no major external or policy shocks, meaning inflation is considered to be under control.

According to the reports, the inflation rate of some food items, however, has risen. Food inflation, which was 6.6 per cent in FY23, increased to 7.5 per cent in FY24, the report said.

The increase in inflation was blamed on bad weather, which made it hard for farmers to grow crops. Farmers also faced challenges from extreme weather events and low water levels in reservoirs.

Retail inflation averaged 6.7% in FY23 but was reduced to 5.4% in FY24 due to the government’s timely actions and the Reserve Bank’s efforts to keep prices stable. The economic survey noted that this is the lowest level since the pandemic.

The Economic Survey marked the government’s “thrust on capex and sustained momentum in private investment has boosted capital formation growth… by nine per cent in real terms in FY24”.

On fiscal balances, the Survey said “tax compliance gains driven by procedural reforms, expenditure restraint, and increasing digitisation” had helped offset “expansionary public investment”.

On the Current Account Deficit, the Survey said , “External balance has been pressured by subdued global demand for goods, but strong services exports largely counterbalanced this…”

But “change is the only constant for a country with high growth aspirations…” The report said, noting that for the high-recovery phase to be sustained “there has to be heavy lifting on the domestic front…”

According to the Economic Survey, the short term outlook is positive but the long term needs a clear vision.